2025 taxes: Minnesota's individual, joint tax brackets announced

For the 2023 tax filing year, a new Child Tax Credit will be available for Minnesotans, up to $1,750 per child, with no limit on the number of children claimed.

ST. PAUL, Minn. (FOX 9) - Minnesota’s Department of Revenue has announced the adjusted 2025 individual income tax brackets that will affect what you could pay beginning next year.

Minnesota tax brackets

What we know: According to the department, income tax brackets are adjusted annually by an inflation factor, and rounded to the nearest $10 based on the change in the U.S. Chained Consumer Price Index (CPI) for all consumers.

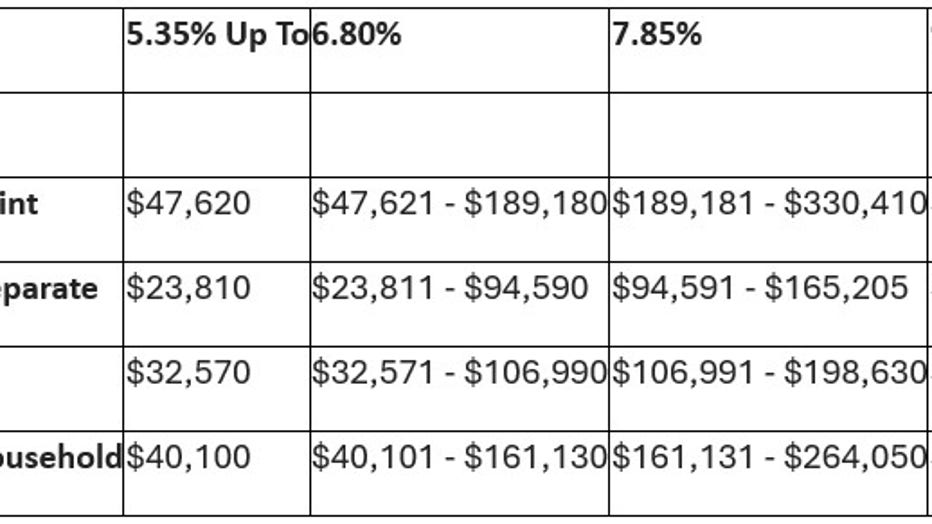

A chart of Minnesota’s 2025 income tax brackets can be found below:

2025 tax brackets for Minnesota filers.

Dependent exemption changes

What we know: Minnesotans taking the standard deduction or dependent exemption at the state level, the calculated amounts for 2025 are:

- Married Filing Joint standard deduction - $29,900

- Married Filing Separate standard deduction - $14,950

- Single standard deduction - $14,950

- Head of Household standard deduction - $22,500

- Dependent exemption - $5,200

You can view a full list of inflation-adjusted tax amounts for tax year 2025 on the department’s website.

New federal tax brackets for 2025

By the Numbers: At the federal level, the IRS is increasing its tax brackets by about 2.75% for both individual and married filers across various income levels in tax year 2025:

- 10%: Taxable income up to $11,925 (previously $11,600 in 2024)

- 12%: Taxable income over $11,925 ($11,600)

- 22%: Taxable income over $48,475 ($47,150)

- 24%: Taxable income over $103,350 ($100,525)

- 32%: Taxable income over $197,300 ($191,950)

- 35%: Taxable income over $250,525 ($243,725)

- 37%: Taxable income over $626,350 ($609,350)

Tax brackets for joint filers:

- 10%: Taxable income up to $23,850 (previously $23,200 in 2024)

- 12%: Taxable income over $23,850 ($23,200)

- 22%: Taxable income over $96,950 ($94,300)

- 24%: Taxable income over $206,700 ($201,050)

- 32%: Taxable income over $394,600 ($383,900)

- 35%: Taxable income over $501,050 ($487,450)

Social security increase

Dig deeper: The Social Security Administration announced a 2.5% cost-of-living increase for benefits recipients starting in January. That translates to an average jump of more than $50 on monthly checks for millions of people.

The Source: Information provided in this article comes from the Minnesota Department of Revenue and the IRS.